The world of digital banking is evolving fast, and Starling Bank has made quite a name for itself—especially in business banking. Launched in 2014 by Anne Boden, Starling has set itself apart with a mobile-first approach, focusing on simplicity and efficiency.

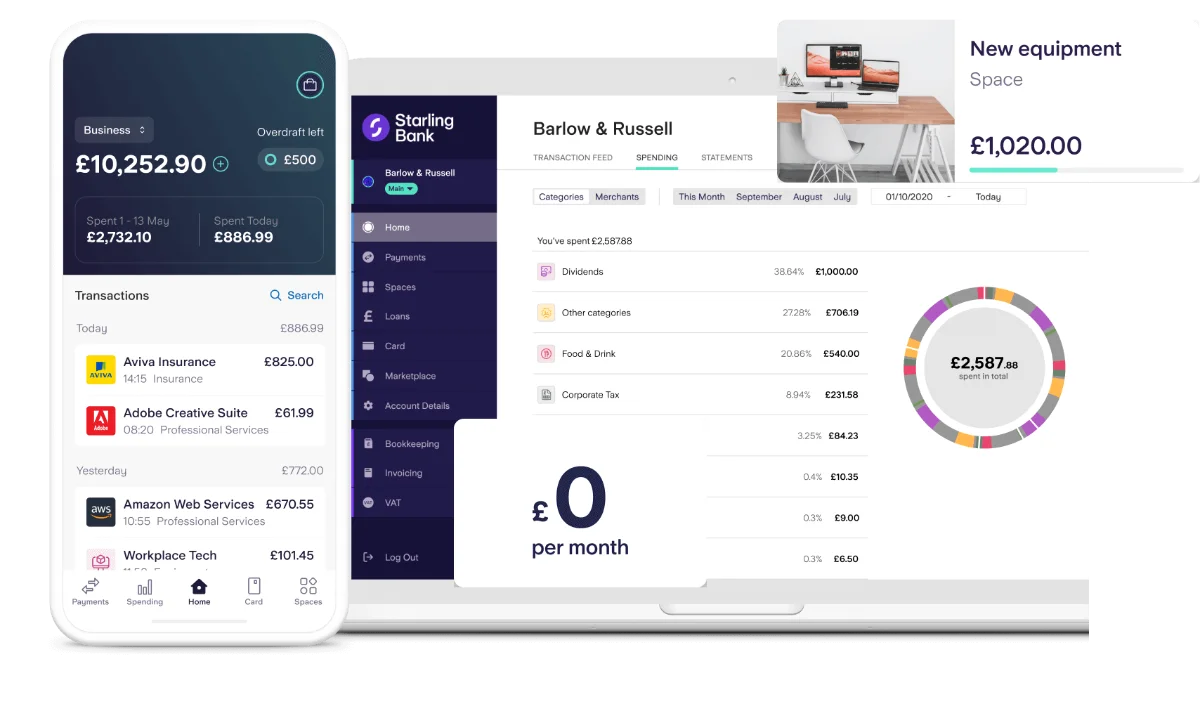

Designed specifically for small and medium-sized enterprises (SMEs), freelancers, and entrepreneurs, Starling’s business account offers a comprehensive suite of tools to make financial management easier. The goal? To let business owners focus on growth while reducing admin headaches.

Key Findings (Pros & Cons)

Pros:

- No Monthly Fees – No maintenance charges make it a cost-effective option for businesses looking to save.

- Real-Time Notifications – Instant alerts help you stay on top of transactions.

- Accounting Software Integration – Works seamlessly with Xero, QuickBooks, and FreeAgent.

- Multi-User Access – Perfect for teams managing finances collaboratively.

- FSCS Protection – Deposits up to £85,000 are safeguarded.

- Instant Payments & Transfers – Supports Faster Payments, Bacs, and CHAPS.

- Multiple Business Accounts – Manage different accounts under a single profile.

- Cash Flow Insights – Real-time financial analysis helps with decision-making.

Cons:

- No Physical Branches – Digital-only banking may not suit all businesses.

- Cash Deposits Can Be Cumbersome – Deposits are possible via the Post Office but come with extra fees.

- International Transactions Can Be Costly – Foreign payments may have higher fees compared to domestic ones.

- Limited Business Loans & Credit – While overdrafts and loans are available, they’re not as extensive as traditional banks.

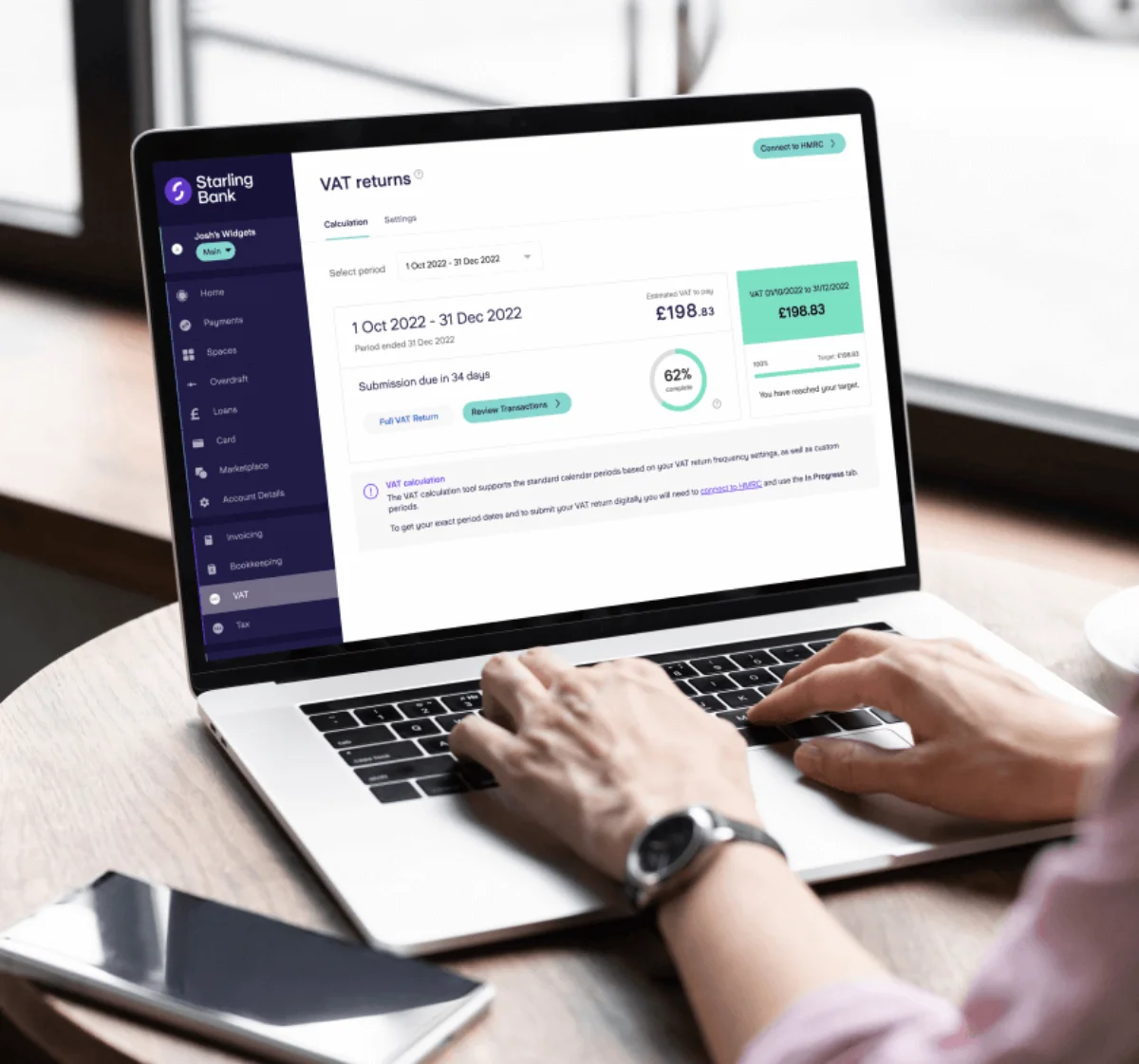

Features & Benefits

Digital-First Banking

Starling operates entirely through its mobile app, meaning no need for branch visits. Signing up is quick—most users complete the process within minutes.

Seamless Accounting Integration

One of its strongest features is smooth integration with major accounting software. Transactions are automatically logged and categorised, reducing manual bookkeeping.

Multi-User Access for Team Management

Got a finance team or business partners? Starling lets you grant different levels of access to team members—great for secure collaboration.

Spaces for Budgeting

The “Spaces” feature lets businesses set aside money for specific expenses, such as taxes and payroll, without needing separate bank accounts.

Instant Notifications & Cash Flow Insights

Get real-time updates on payments and spending patterns. The app even offers insights to help manage finances better.

Foreign Transactions & Multi-Currency Accounts

Starling supports international payments and multi-currency accounts, though it’s worth checking exchange rates and fees before making transactions.

Overdrafts & Business Loans

While Starling doesn’t offer large business loans, it does provide overdrafts and loans up to £250,000 (subject to approval). Handy for short-term funding needs.

Security & FSCS Protection

Starling takes security seriously, with encryption, biometric authentication, and fraud prevention tools. Plus, deposits up to £85,000 are protected under the FSCS.

Quality & Performance

Reliability of the Starling App

Users consistently praise the app for its reliability and intuitive design. Downtime is rare, and the interface makes business banking simple—even for those with no prior experience.

Transaction Speed

With Faster Payments, transactions go through instantly. Bacs and CHAPS are also supported, providing flexibility for different business needs.

User Experience

Ease of Use

The app’s clean interface makes it easy to manage invoices, payments, and cash flow. Small business owners and freelancers particularly appreciate how user-friendly it is.

Customer Satisfaction

Starling enjoys positive reviews for its seamless account setup, real-time alerts, and accounting software integration. The main downsides? Cash deposit challenges and the absence of physical branches.

Pricing & Subscription Options

No Monthly Fees

Starling doesn’t charge monthly maintenance fees, making it a budget-friendly choice for startups and small businesses.

Transaction Fees

- Domestic Transactions – Free Faster Payments, Bacs, and CHAPS.

- International Transfers – Processed via Wise, with fees depending on the destination and currency.

- Cash Deposits – Handled through the Post Office, with a £3 fee for deposits under £1,000 and 0.3% for amounts above £1,000.

- Business Overdrafts – Interest rates vary based on creditworthiness.

Reliability & Support

Customer Support Channels

Support is available via in-app chat, email, and phone. Businesses generally report quick and helpful responses.

Knowledge Base & Educational Resources

Starling provides a wealth of online resources, including FAQs, blog articles, and financial guides.

Frequently Asked Questions (FAQs)

Who can open a Starling Bank Business Account?

Starling Bank’s business account is available to sole traders, limited companies, and partnerships registered in the UK. The applicant must be over 18, a UK resident, and have a registered business operating within the UK.

Does Starling Bank charge monthly fees for its business account?

No, Starling Bank does not charge any monthly maintenance fees for its business account, making it a cost-effective choice for SMEs and freelancers. However, some additional services, such as cash deposits and international payments, may incur fees.

How do I deposit cash into my Starling Bank business account?

Cash deposits can be made at any Post Office branch across the UK. However, Starling Bank charges a small fee for cash deposits—0.7% of the deposited amount, with a minimum charge of £3 per deposit.

Does Starling Bank offer overdrafts or business loans?

Yes, Starling Bank provides business overdrafts and loans. Overdraft limits vary depending on the business’s creditworthiness, and interest rates are competitive. Business loans are also available for eligible businesses, with flexible repayment terms.

Can I integrate my Starling Bank account with accounting software?

Yes, Starling Bank integrates seamlessly with popular accounting software like Xero, QuickBooks, and FreeAgent. This integration helps automate bookkeeping, reducing manual data entry and improving financial management.

Is Starling Bank safe and secure?

Yes, Starling Bank is regulated by the Financial Conduct Authority (FCA) and the Prudential Regulation Authority (PRA). Deposits are protected up to £85,000 under the Financial Services Compensation Scheme (FSCS), ensuring financial security.

Does Starling Bank support international payments?

Yes, Starling Bank allows international payments. While international transfers are available, they may incur fees depending on the currency and destination. Starling Bank provides a multi-currency account for businesses handling frequent international transactions.

Can multiple people access the business account?

Yes, Starling Bank allows multi-user access, making it ideal for businesses with finance teams or co-owners who need access to banking features. Account permissions can be customised to control user access levels.

How do I contact Starling Bank’s customer support?

Starling Bank offers customer support via in-app chat, email, and phone. Support is available 24/7, ensuring businesses can get help whenever needed.

How do I apply for a Starling Bank business account?

The application process is entirely online and takes only a few minutes. Applicants need to provide basic business details, proof of identity, and relevant business documentation. Once approved, the account can be accessed instantly via the mobile app.

Final Verdict: Is Starling Bank Right for Your Business?

Starling Bank offers a strong, cost-effective business banking solution—ideal for SMEs, freelancers, and entrepreneurs who prefer digital banking. With no monthly fees, a user-friendly app, and excellent accounting integrations, it ticks most boxes for modern businesses.

However, if you frequently deposit cash or need in-person banking services, it may not be the best fit. For those comfortable with digital banking, though, Starling is a top contender in the UK business banking scene.