Managing finances is vital for small businesses and freelancers, but it can be tough. Countingup is a UK fintech company. It wants to make financial management easier. They provide a special mix of a business current account and accounting software. Founded in 2017, Countingup quickly gained popularity among sole traders and small business owners. They appreciate its easy-to-use, automated financial tool that cuts down on administrative tasks.

In this review, we explore the features, benefits, pricing, and performance of Countingup. We analyse key parts of this all-in-one banking solution. This helps us see if Countingup is a good fit for entrepreneurs seeking easy financial management.

Key Findings (Pros & Cons)

Pros:

- Integrated Banking and Accounting: Eliminates the need for multiple platforms, simplifying financial management.

- User-Friendly Interface: Simple and easy to use, even for beginners in accounting.

- Automated Financial Processes: Invoicing, tracking expenses, and tax calculations cut down on manual work.

- Real-Time Financial Insights: Users get instant notifications on transactions. This keeps them updated on their cash flow.

- Competitive Pricing: A cost-effective solution tailored for small businesses and freelancers.

Cons:

- Limited to UK Businesses: Not available for businesses operating outside the UK.

- No Personal Banking Features: This is for business use only, so it may not fit those seeking personal finance options.

- Limited Advanced Accounting Tools: Might not suit larger businesses with complex accounting needs.

Features & Benefits

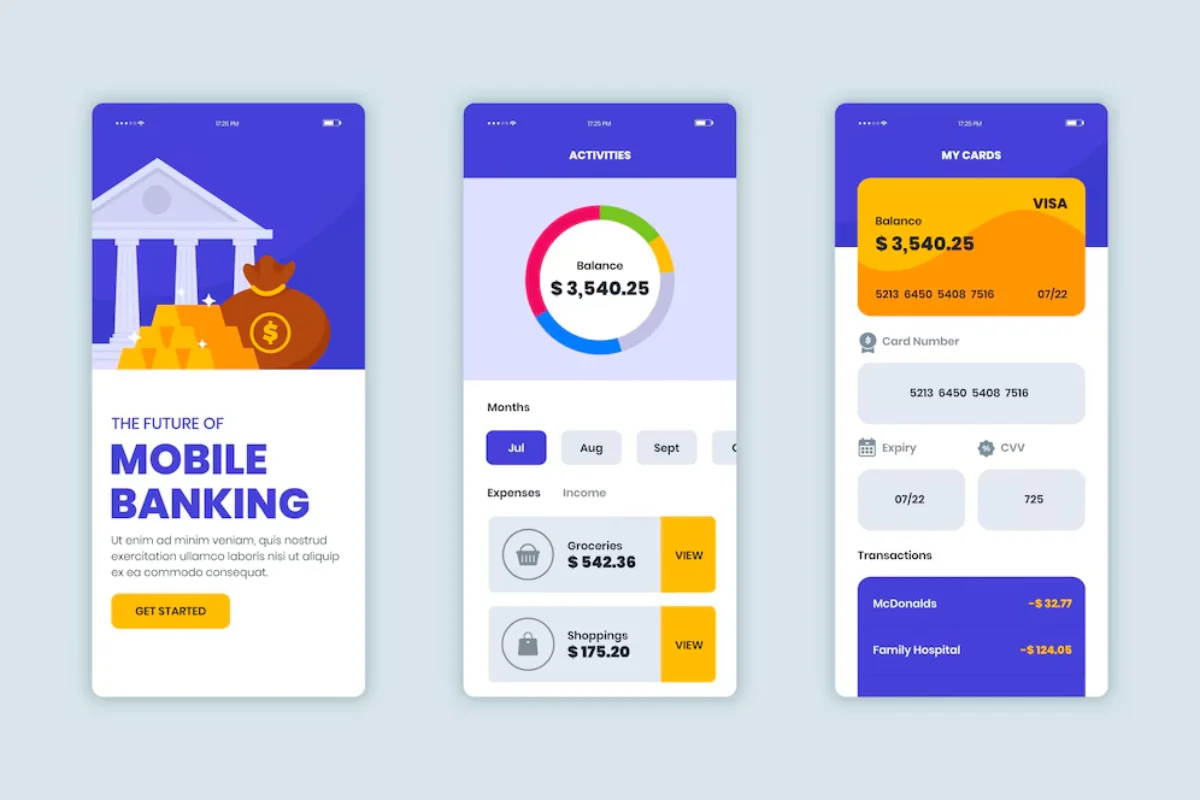

Countingup stands out by combining business banking with key accounting tools. This offers users a smooth experience. Here are the key features and benefits of Countingup:

Integrated Business Banking and Accounting

Countingup combines banking and accounting in one app. This means you no longer have to switch between different platforms. This integration lets users handle their financial records, invoices, and bank transactions all in one place. This makes managing finances much easier.

Automated Invoicing and Expense Management

- Invoice Creation: Users can generate and send professional invoices directly from the app.

- Expense Categorisation: Transactions are automatically sorted into categories, reducing bookkeeping time.

- Receipt Scanning: Users can snap photos of receipts. Then, they are matched to transactions for easy record-keeping.

Real-Time Notifications and Financial Insights

- Instant Transaction Alerts: Users receive real-time updates on incoming and outgoing payments.

- Financial Overview Dashboard: The app shows income, expenses, and cash flow. This helps you make better financial decisions.

- Tax Estimation: Automated estimates for VAT and corporation tax help users get ready for their tax duties.

Tax Filing and HMRC Integration

- Self-Assessment Guidance: Helps sole traders calculate and track their tax liabilities.

- MTD-Ready VAT Returns: Countingup complies with the UK government’s Making Tax Digital (MTD) initiative. It simplifies VAT reporting.

- Accountant Collaboration: Users can grant accountants access to their financial records. This makes tax filing more efficient.

Quality & Performance

Countingup is designed to handle the financial operations of small businesses efficiently. The app’s functionality is reliable, with minimal downtime reported by users. Transactions are processed quickly, and financial updates appear in real-time. Users appreciate the seamless banking-accounting integration. This reduces administrative workload and enhances overall efficiency.

User Experience

Countingup is widely praised for its user-friendly design. The app is intuitive, catering to business owners without extensive financial knowledge. The dashboard is well-organised, providing clear insights into income, expenses, and pending invoices. Users particularly value the automation features. This saves them time and effort in managing their finances.

Pricing & Subscription Options

Countingup offers a transparent pricing model. This makes it an attractive choice for small businesses. The platform provides a free trial period. This allows users to explore features before committing to a subscription. Pricing is structured to accommodate different business sizes. This ensures affordability without compromising on essential features.

- Free Trial: New users can test the service before subscribing.

- Monthly Subscription Plans: Pricing tiers cater to different business needs, providing flexibility.

- No Hidden Fees: Transparent pricing structure ensures cost-effectiveness.

Reliability & Support

Customer support is a critical aspect of any financial service, and Countingup delivers in this area. The company provides UK-based customer service. You can get help through email and chat. Users report high satisfaction with the support team. It highlights their efficiency in resolving queries.

- Dedicated Customer Support: Assistance is available via chat and email.

- Comprehensive Help Centre: Users can access FAQs and guides for troubleshooting.

- Accountant Support: Enables seamless collaboration with professional accountants.

Pro Tip

Freelancers and small business owners can make tax filing easier by integrating Countingup with an external accountant. This helps with financial planning too. The platform lets accountants access records easily. This helps them manage information better and lowers the chances of tax mistakes.

Important

Countingup is MTD-compliant. Businesses required to file VAT returns under Making Tax Digital regulations can do so directly through the app. This feature keeps users compliant with HMRC rules. There’s no need for extra software.

Quick Guide: Getting Started with Countingup

- Sign Up: Download the Countingup app and register your business.

- Verify Your Business: Complete identity and business verification steps.

- Start Banking: Receive your business’s current account details and begin making transactions.

- Automate Accounting: Set up invoice templates, expense tracking, and tax estimation.

- Monitor Finances: Use real-time insights to track income, expenses, and cash flow.

FAQs

Who is Countingup best suited for?

Countingup is perfect for freelancers, sole traders, and small business owners in the UK. It offers a simple and automated way to manage banking and accounting all in one app.

Can I use Countingup for personal banking?

No, Countingup is exclusively designed for business use and does not offer personal banking features.

Is Countingup compatible with HMRC’s Making Tax Digital requirements?

Yes, Countingup supports MTD for VAT, making it easy for businesses to comply with HMRC regulations.

Does Countingup integrate with external accounting software?

Countingup provides built-in accounting tools. Users can grant their accountants access to financial records for additional accounting support.

How much does Countingup cost?

Countingup offers a free trial, followed by affordable subscription plans. The exact pricing depends on the chosen plan.

How secure is Countingup?

Countingup uses industry-standard security measures. These include encryption and authentication protocols to protect user data and transactions.

Can I accept card payments through Countingup?

Currently, Countingup does not offer direct card payment processing. There is support for integration with other payment services.

Conclusion: A Smart Choice for Small Business Banking

Countingup offers a smart and simple way for small business owners to manage their finances better. Combining business banking with automated accounting makes tasks easier. It simplifies invoicing, tracks expenses, and calculates taxes. The platform is easy to use. It offers real-time financial insights and follows HMRC rules. This makes it a great tool for freelancers and small businesses.

Countingup may not fit larger businesses or those needing advanced accounting features. However, it is a great option for UK small business owners who want an affordable, all-in-one financial management solution. Countingup is a trusted banking and accounting partner for today’s entrepreneurs. It offers clear pricing, quick customer support, and strong automation tools.